________________

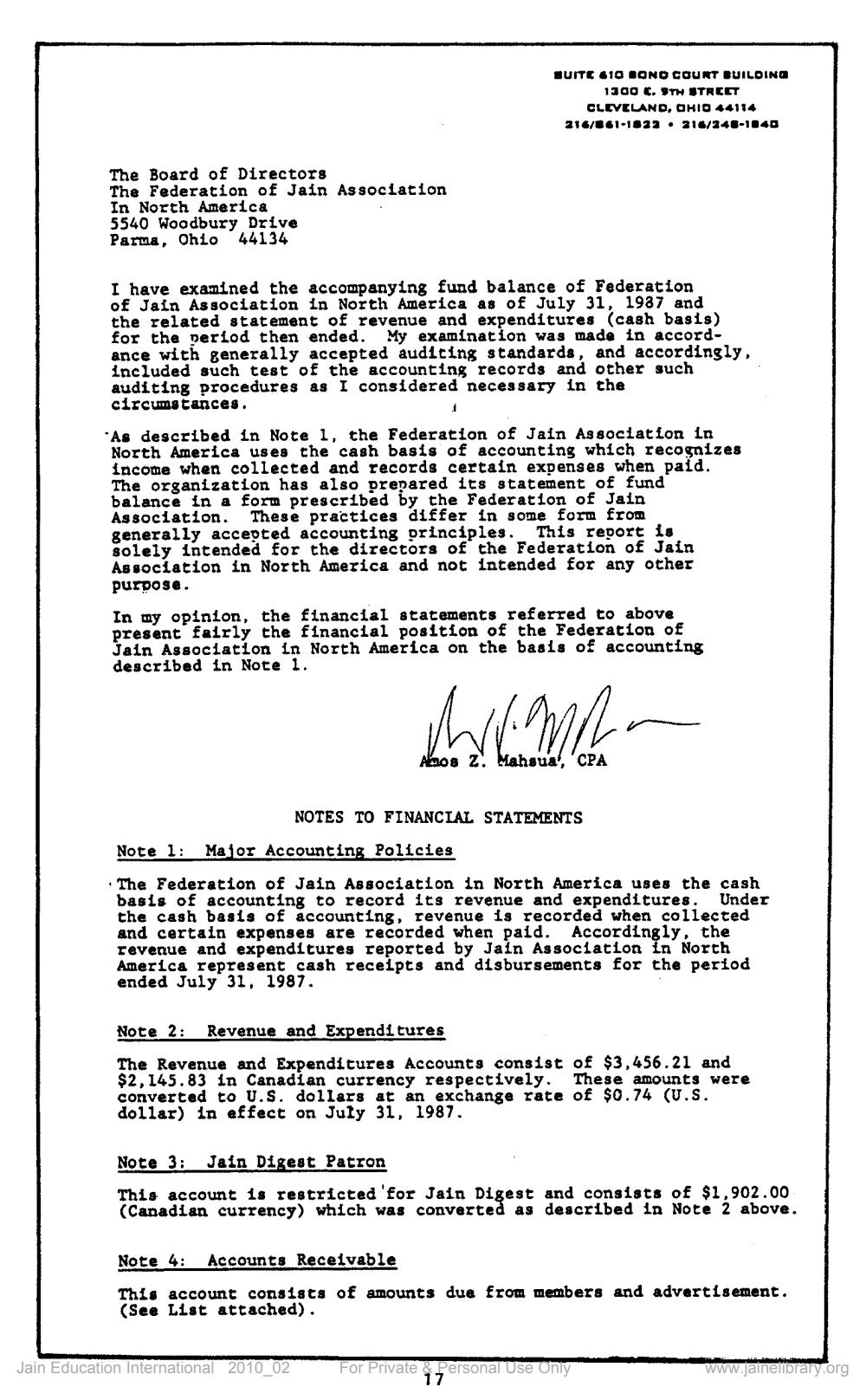

SUITE 610 IONO COURT BUILDING

1300 c. 9TH STREET CLEVELAND, OHIO 44114 216/061-1832 • 216/245-1140

The Board of Directors The Federation of Jain Association In North America 5540 Woodbury Drive Parma, Ohio 44134

I have examined the accompanying fund balance of Federation of Jain Association in North America as of July 31, 1987 and the related statement of revenue and expenditures (cash basis) for the period then ended. My examination was made in accordance with generally accepted auditing standards, and accordingly, included such test of the accounting records and other such auditing procedures as I considered necessary in the circumstances.

As described in Note 1, the Federation of Jain Association in North America uses the cash basis of accounting which recognizes income when collected and records certain expenses when paid. The organization has also prepared its statement of fund balance in a form prescribed by the Federation of Jain Association. These practices differ in some form from generally accepted accounting principles. This report is solely intended for the directors of the Federation of Jain Association in North America and not intended for any other purpose. In my opinion, the financial statements referred to above present fairly the financial position of the Federation of Jain Association in North America on the basis of accounting described in Note 1.

Los Z! Mahsua', 'CPA

NOTES TO FINANCIAL STATEMENTS

Note 1: Maior Accounting Policies

• The Federation of Jain Association in North America uses the cash basis of accounting to record its revenue and expenditures. Under the cash basis of accounting, revenue is recorded when collected and certain expenses are recorded when paid. Accordingly, the revenue and expenditures reported by Jain Association in North America represent cash receipts and disbursements for the period ended July 31, 1987.

Note 2: Revenue and Expenditures

The Revenue and Expenditures Accounts consist of $3,456.21 and $2,145.83 in Canadian currency respectively. These amounts were converted to U.S. dollars at an exchange rate of $0.74 (U.S. dollar) in effect on July 31, 1987.

Note 3: Jain Digest Patron This account is restricted 'for Jain Digest and consists of $1,902.00 (Canadian currency) which was converted as described in Note 2 above.

Note 4: Accounts Receivable

This account consists of amounts dua from members and advertisement. (See List attached).

Jain Education International 2010_02

For Private

Personal use only

www.ainelibrary.org