________________

the training is of six months with maximum training expenses of Rs. 1,500 p.m. per trainee. During the training a stipend of Rs. 1,000 p.m. is also paid to the trainees. The training cost and stipend is met by NMDFC as grant. After the training, nced based micro credit subject to a maximum of Rs. 1.00 lac is made available to each member of SHG, so formed at an interest rate of 7% p.a.

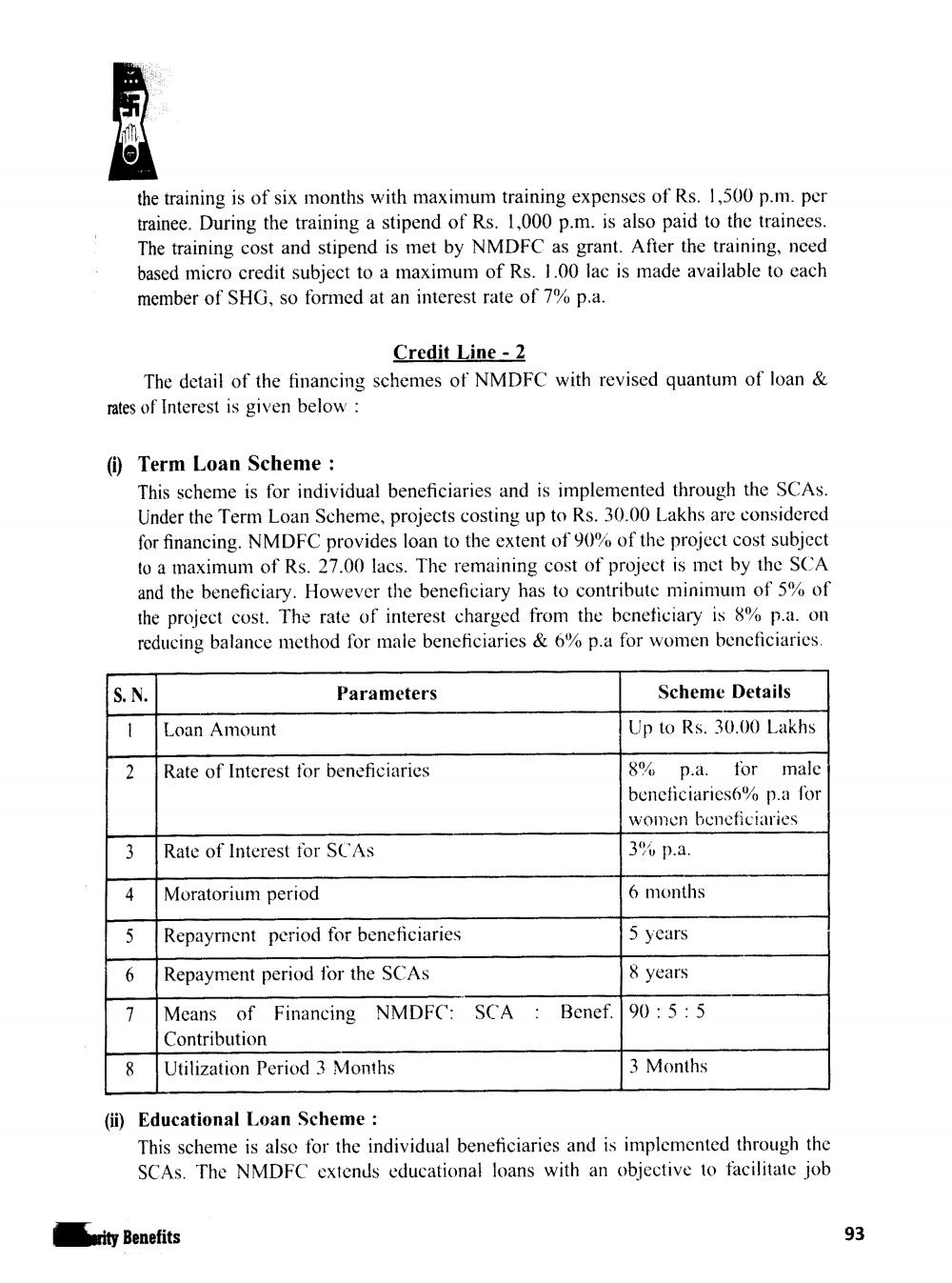

Credit Line - 2 The detail of the financing schemes of NMDFC with revised quantum of loan & rates of Interest is given below:

(i) Term Loan Scheme:

This scheme is for individual beneficiaries and is implemented through the SCAs. Under the Term Loan Scheme, projects costing up to Rs. 30.00 Lakhs are considered for financing. NMDFC provides loan to the extent of 90% of the project cost subject to a maximum of Rs. 27.00 lacs. The remaining cost of project is met by the SCA and the beneficiary. However the beneficiary has to contribute minimum of 5% of the project cost. The rate of interest charged from the beneficiary is 8% p.a. on reducing balance method for male beneficiaries & 6% p.a for women beneficiaries.

S.N.

Parameters

Scheme Details

Loan Amount

Up to Rs. 30.00 Lakhs

2

Rate of Interest for beneficiaries

8% p.a. for male beneficiaries6% p.a for women beneficiaries 3% p.a.

3

Rate of Interest for SCAs

Moratorium period

6 months

5

Repayrnent period for beneficiaries

5 years

6

Repayment period for the SCAs

8 years Means of Financing NMDFC: SCA · Benef. 90:5:5 Contribution Utilization Period 3 Months

3 Months

8

(ii) Educational Loan Scheme :

This scheme is also for the individual beneficiaries and is implemented through the SCAs. The NMDFC extends educational loans with an objective to facilitate job

writy Benefits

93