________________

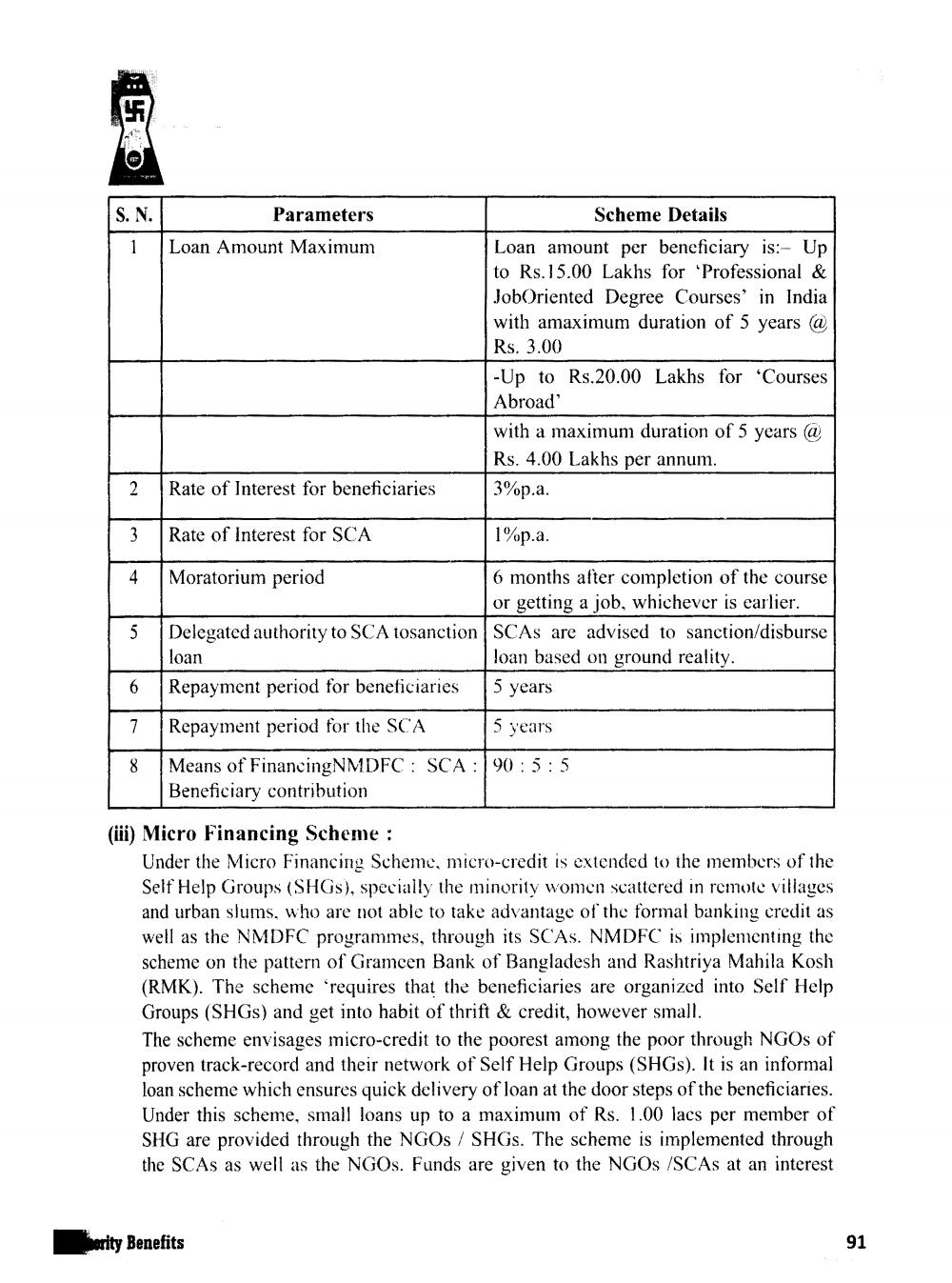

Parameters Loan Amount Maximum

1

Scheme Details Loan amount per beneficiary is:- Up to Rs.15.00 Lakhs for Professional & JobOriented Degree Courses in India with amaximum duration of 5 years @ Rs. 3.00 - Up to Rs.20.00 Lakhs for 'Courses Abroad with a maximum duration of 5 years @ Rs. 4.00 Lakhs per annum. 3%p.a.

2

Rate of Interest for beneficiaries

3

Rate of Interest for SCA

1%p.a.

5

Moratorium period

6 months after completion of the course

or getting a job, whichever is earlier. Delegated authority to SCA tosanction SCAs are advised to sanction/disburse loan

loan based on ground reality. Repayment period for beneficiaries 5 years

7

Repayment period for the SCA

5 years

8

Megne

Means of FinancingNMDFC : SCA:90: 5:5 Beneficiary contribution

(iii) Micro Financing Scheme:

Under the Micro Financing Scheme, micro-credit is extended to the members of the Self Help Groups (SHGs), specially the minority women scattered in remote villages and urban slums, who are not able to take advantage of the formal banking credit as well as the NMDFC programmes, through its SCAS. NMDFC is implementing the scheme on the pattern of Grameen Bank of Bangladesh and Rashtriya Mahila Kosh (RMK). The scheme 'requires that the beneficiaries are organized into Self Help Groups (SHGs) and get into habit of thrift & credit, however small. The scheme envisages micro-credit to the poorest among the poor through NGOs of proven track-record and their network of Self Help Groups (SHGs). It is an informal loan scheme which ensures quick delivery of loan at the door steps of the beneficiaries. Under this scheme, small loans up to a maximum of Rs. 1.00 lacs per member of SHG are provided through the NGOs/SHGs. The scheme is implemented through the SCAs as well as the NGOs. Funds are given to the NGOs /SCAs at an interest

herity Benefits

91